Blog

Benefits of Tax Deposits in Mexico

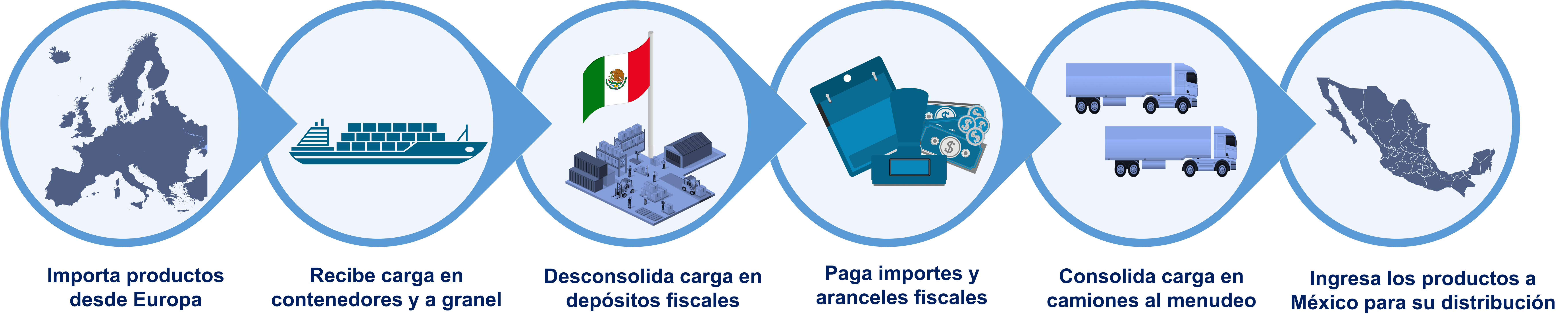

The import and export of products in Mexico requires powerful machinery from logistics and distribution services. Among the advantages of the consolidation of merchandise are the customs and tariff benefits of the fiscal warehouses in Mexico under the customs law.

The logistics in Mexico has international projections. Many times the suppliers of the Mexican industry receive large volumes of cargo to gradually distribute over time. However, they are faced with a dilemma: will they have to pay all import taxes and duties on that cargo immediately?

An immediate payment of all taxes It reduces the liquidity of companies , since it forces them to pay a significant sum of money for products that, although they are already in Mexico, they do not need to send or invoice yet.

For this reason, the Mexican government allowed the creation of controlled warehouses to promote the development of the industry and international logistics. According to the Ministry of Finance and Public Credit (SHCP) of Mexico, this allows the “Storage of merchandise of foreign or national origin in General Warehouses of Fiscal Deposit”.

Under this tax warehouse regime, importing companies of certain products have the option of postponing the choice of the specific import regime for that cargo, and it allows them to store the merchandise. As long as they consider, as long as they have a storage contract that supports them and that they are paying.

With this, companies have several options with tax deposits in Mexico:

- Extract all or part of the merchandise for importation, after payment of taxes, with its corresponding readjustment.

- Return your merchandise abroad by internal transit (IMMEX).

- Commercialize those goods in warehouse.

What is a controlled warehouse? What companies can offer these services?

In 2006, the Federal Government of Mexico published the Decree for the Promotion of the Manufacturing Industry, Maquiladora and Export Services . This is the IMMEX Decree, to strengthen the competitiveness of the country’s export sector, and provide more certainty, transparency and continuity to the operations of the companies.

Among other benefits a tax deposit:

- It specifies and simplifies the factors that import and export companies must comply with.

- It allows to develop new ways of operating businesses.

- Reduces logistics and administrative costs.

- Modernize , streamline and reduce paperwork.

- What type of products benefit from these benefits?

- High technology

- Automotive industry

- Mass consumer products

- Raw Materials

How a fiscal warehouse works

The importance of having certified companies in fiscal warehouses

For this, an agency such as a strategic fiscal deposit must be duly authorized. The Mexican Ministry of Economy may authorize certain companies to operate programs such as business control, industrial, services, shelter or outsourcing.

The international trade of IMMEX generates 239 thousand 628 million dollars in exports a year, in addition to the fact that more is being sold than is imported, the Chamber of Deputies has reported.

Although the IMMEX program is one of the main export programs in Mexico, It is important that companies that want to benefit choose a duly certified warehouse for the transit of goods and according to the types of logistics services required, such as cargo consolidation or abandonment of goods.

In December 2016, The Ministry of Economy announced adjustments to the operation of non-certified IMMEX companies to avoid abuses of the program, according to El Economista.

Among these changes, the government will improve control of the amount of merchandise and how it is authorized in relation to its installed productive capacity.

“According to the federal government, the aforementioned certified company model has worked in a ‘correct and expeditious’ manner, and has generated that the Tax Administration Service (SAT) maintains a registration of companies that carry out foreign trade operations , which are granted various benefits in the import and export of merchandise “, reports The Economist .

Do you have questions or queries regarding the operation of the tax storage regime in Mexico?

{{cta (‘.’)}}

¿Quiere más información?

Déjenos sus datos y nos pondremos en contacto.